Mar 19, 2020

Hospitality businesses will be eligible for immediate financial assistance, unemployment benefits for workers expanded

Governor John Carney on Wednesday announced the Hospitality Emergency Loan Program (HELP) to provide financial relief for restaurants, bars and other hospitality industry businesses that employ thousands of Delawareans.

“Restaurants, bars, hotels, and other hospitality-related businesses, and their workers, are among those most seriously impacted by the Coronavirus (COVID-19) in Delaware,” said Governor John Carney. “We’ve limited restaurants to takeout and delivery services and asked all Delawareans to avoid being out in public unnecessarily. Many people from other states have postponed non-essential travel, meaning they are not coming to Delaware for vacations or business. We feel it is crucial that the state step in to assist these businesses and their employees.”

The no-interest loans are capped at $10,000 per business per month. The money can cover rent, utilities and other unavoidable bills but cannot be used for personnel costs. The loans have a 10-year term with payments deferred for nine months.

The Division of Small Business will administer the program using existing state funds and is aiming to have an application available later this week. Eligible businesses must have been in operation for at least a year, have annual revenue below $1.5 million and be in a certain hospitality-connected industries. Email [email protected] to learn if you qualify or call 302-739-4271 with additional questions.

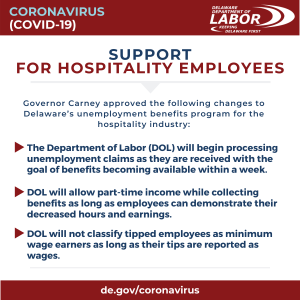

Assistance is also available for Delaware workers impacted by the coronavirus outbreak. Governor Carney approved the following changes to Delaware’s unemployment benefits program for the hospitality industry:

The Department of Labor (DOL) will begin processing unemployment claims as they are received with the goal of benefits becoming available within a week.

DOL will allow part-time income while collecting benefits as long as employees can demonstrate their decreased hours and earnings.

DOL will not classify tipped employees as minimum wage earners as long as their tips are reported as wages.

Businesses applying for assistance through Delaware’s HELP program will need to prove they meet the eligibility standards. This includes providing documentation to show the business has been current for at least 80 percent of payments over the past 12 months, and not past due on its most recent payment on any bill for which it is applying for relief. This can be done through proof of payments or a letter from the entity to which the money was due.

The program announcement comes as the state also awaits official confirmation from the U.S. Small Business Administration that it has received the Economic Injury Declaration which Governor Carney formally requested on Monday.

More information will be available later in the week on sending in application information for HELP. In the meantime, businesses can reach out to the Division of Small Business with questions by emailing [email protected] or visiting www.delbiz.com.

Delawareans with questions about COVID-19 or their exposure risk can call the Division of Public Health’s Coronavirus Call Center at 1-866-408-1899 or 711 for people who are hearing impaired from 8:30 a.m. to 8:00 p.m. Monday through Friday, and 10 a.m. to 4 p.m. Saturday and Sunday, or email [email protected]. For the latest on Delaware’s response, go to de.gov/coronavirus.